does wells fargo offer mortgage protection insurance

Alongside making you aware of the need for life insurance, Mortgage Policies on life can also be an excellent deal for specific individuals. Check out the following article to determine whether you're among those who think this product is suitable.

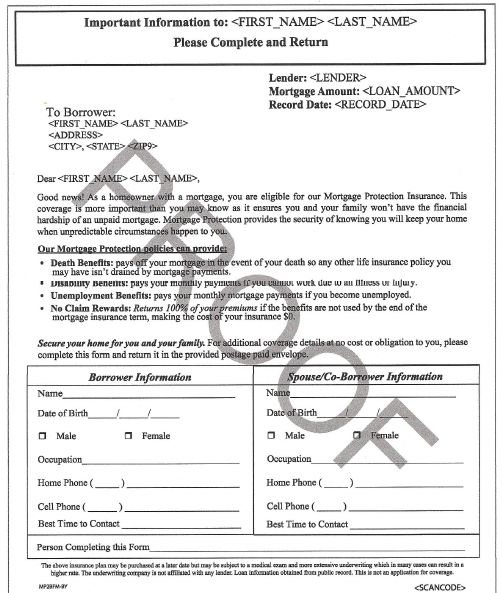

It's an excellent idea for anyone with a family dependent on income to carry an insurance policy for life; that is the term. This is the kind of Mortgage protection policy.